The Risks of Disconnection in a Hyperconnected World

Sometimes a thousand twangling instruments

Will hum about mine ears, and sometime voices

The Tempest (III, ii)

Digital Dystopia

We do business in an era of digital dystopia. In many areas of the modern world, our relationships are now defined in part, if not in whole, by digital transactions. Our words, our ideas and our very identities infiltrate the digital landscape—leaving trails of data as pen marks recording pieces of our legacies on the world around us. These marks reach faster, further and at a higher velocity than light itself, and they accumulate around us in piles of structured and unstructured data. But, is this data truly bringing the world closer together?

We’re at the cusp of the change in an era.

Anthony Scriffignano, Chief Data Scientist, Dun & Bradstreet

Airbnb owns few assets and no hotels. In short order, Airbnb will pass Hilton Worldwide and InterContinental Hotels Group as the largest hotelier in the world. Its operating model is based on the digital exchange of data. A room owner has a room to rent. A renter needs a room for a night. Owner lists the room. Renter selects room, pays and stays. They do not meet in person. The transaction, relationship and experience is digitally facilitated even as it’s consumed in the physical world. Even ten years ago, this business model would have seemed like a Brave New World indeed. Without data flowing through digital properties, the two parties would never have connected over physical property. The nature of business relationships has changed.

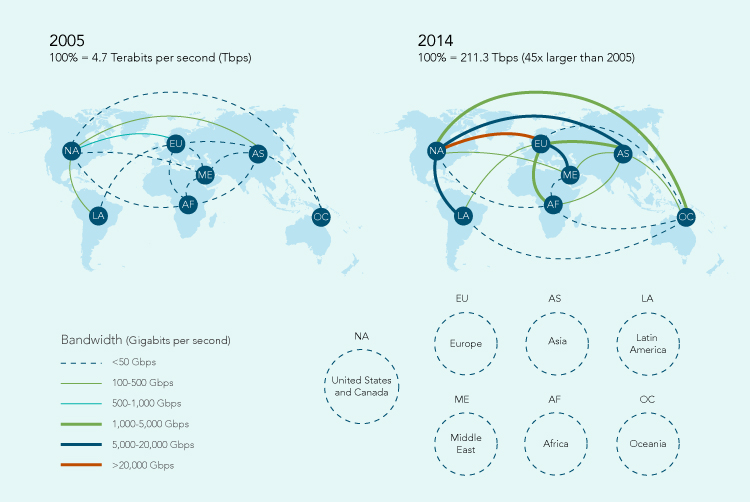

The McKinsey Global Institute recently released its report, Digital Globalization: The New Era of Global Flows, showing that the world is converging over digitization. “The amount of cross-border bandwidth that is used has grown 45 times larger since 2005. It is projected to increase by an additional nine times over the next five years as flows of information, searches, communication, video, transactions and intracompany traffic continue to surge.” Up to 12 percent of global goods trade is conducted via international e-commerce today. Cross-border communication has impacted almost every corner of the world and continues to rise.

Image Source: Digital Globalization: The New Era of Global Flows by McKinsey Global Institute

Yet, the connectedness the modern world enjoys hasn’t extended to all corners or resulted in a positive impact across the board. McKinsey also reports that flows are concentrated among a few digital epicenters in advanced economies, with many developing economies lagging far behind in bandwidth and digital trade. “Although there is substantial value at stake, not all countries are making the most of this potential. The latest MGI Connectedness Index-which ranks 139 countries on inflows and outflows of goods, services, finance, people, and data-finds large gaps between a handful of leading countries and the rest of the world.” Connectedness and data do not, it seems, necessarily translate to positive global business relationships.

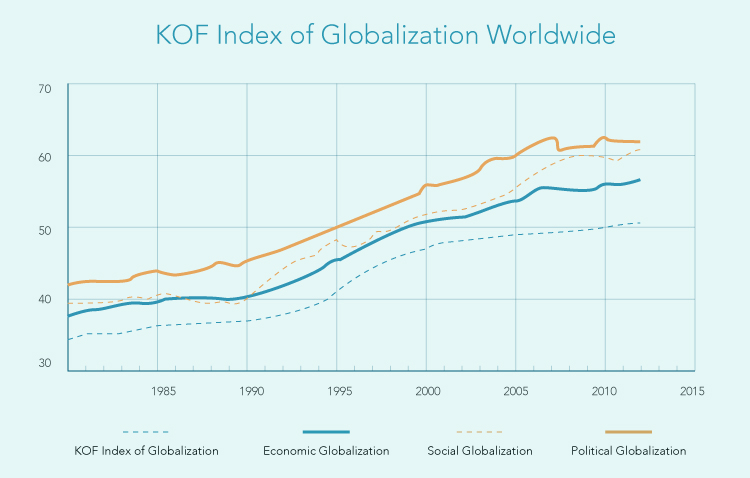

In spite of the increased connectedness in advanced economies, the world also might just be getting smaller. The Zurich-based research organization KOF Swiss Economic Institute, which produces a comprehensive globalization index measuring economic, social and political globalization, has found that the growth of globalization throughout the 1990s and 2000s has actually stalled since the 2008 financial crisis.

Image Source: Image Source: The KOF Index of Globalization Press Release: March 4, 2016

Massive public debt coming out of the recession and political turmoil are cited as potential causes of the plateau in globalization. And, the effects of this slowdown are far-reaching. Long-term damage such as dissipation of economic growth, a legacy of toxic politics and a slowdown in innovation are just some of the effects of what some experts are calling deglobalization—a stagnation or contraction in cross-border relationships. Current events seem to be bearing this out. The recent Brexit Leave vote, uneasy trade relations among countries, reduced GDP growth worldwide and the emergence of more restrictive migration policies all point to a global relational environment that is contracting, not expanding, according to Dun & Bradstreet’s economists. McKinsey notes that there is a decreased movement in goods and trade since the 2008 recession, one of the key symptoms of deglobalization.

Image Source: Digital Globalization: The New Era of Global Flows by McKinsey Global Institute

Recently, Dun & Bradstreet’s Senior Economist, Bodhi Ganguli, weighed in on the Top 5 Risks Finance Leaders Face, and the concept of deglobalization lurked menacingly under the surface of each of them. “Much of the modern world has enjoyed the benefits of globalization, which has largely been perceived as positive. Yet, political turmoil, socioeconomic upheaval and territorial conflict characterize the flavor of world relations today due to a sense among some populations that the benefits of globalization haven’t translated to all.” In the midst of this turmoil, says Ganguli, is a fragmenting of populations, trade agreements and sociopolitical relationships. History suggests that periods of deglobalization like the one we’re now in can have effects that last for decades-including isolationism in rich countries.

Yet, globalization isn’t really going away-at least in the digital sense. “There are certainly parts of the world that are behaving in a more isolationist way, and using data to do it. But deglobalization is a bit of an illusion in some ways. You can retrench and be less global if you want. Companies, countries have the ability to some extent to shift the amount of dependency they have on cross-border debt, on cross-border imports and exports and balance of trade. But, at the end of the day, supply chains are global; value chains are global. Customers are everywhere. It’s like trying to prevent oxygen from crossing the borders,” says Dun & Bradstreet Chief Data Scientist, Anthony Scriffignano. So, if there’s no preventing the spread of most data across borders, what does deglobalization mean for business relationships?

Our data is growing, but our relationships are fragmenting.

We know that technology is connecting us more than ever. We know that our capacity to communicate with each other is at an all-time high, and at breakneck speed. And, we also know that digital and data flows may replace, or at least supplement, the concept of globalization, contributing at least 10% to world GDP and adding $7.8 trillion in 2014 alone. Yet, although these patterns are emerging, the risks of disconnection are also very real.

Because we’re in the age of data, we have the ability to look at data to find patterns.

Bodhi Ganguli, Senior Economist, Dun & Bradstreet

Finance leaders must reckon with risk. And what this means today is very different from what it meant even a year ago. Scriffignano articulates this shift, “We’re at the cusp of the change in an era.” Risk and opportunity are embedded in data, in digital communication, in the dizzying pace of innovation. “The financial community changes at its own pace, but at the same time this idea of risk is getting turned on its ear by data. If you think about the kind of risks that an organization faces, the types of risks that it had yesterday don’t go away.” Yet concurrently, Scriffignano states, finance leaders must also think about new threats that deglobalization poses such as cyber security, cyber terrorism and the new dynamic of cross-border decision-making today. All must be grappled with. All must be accounted for. What we haven’t reckoned with, or even begun to understand, is the risk of disconnection in the midst of hyperconnection.

Although we have more data flowing from all corners of the earth in soaring quantities, the risk we face is that we will become dissociated from it as the world shifts to new patterns of buying, selling and relating.

Abigail Lutte, Finance, Credit & Risk, Dun & Bradstreet

The new tightrope to walk is the dividing line between a world drowning in data and a world closing in on itself.

“The price of light is less than the cost of darkness.”

Arthur C. Nielsen, Market Researcher & Founder of ACNielsen

How can finance leaders combat the risks of global, economic and digital disconnection while strategically managing the possibilities that digital connection has created? Although we have more data flowing from all corners of the earth in soaring quantities, the risk we face is that we will become dissociated from it as the world shifts to new patterns of buying, selling and relating. “There are always going to be the risk of competition. There’s going to be counter-party risk; there’s going to be risk from things like fraud; there’s going to be risk from inter-company transactions and currency arbitrage. But if you think about a simple decision like extending credit, you can make that decision the way you used to yesterday by looking at things like a credit report or payment behavior. Or you can start to use things like behavioral analytics, and deep learning, and some of these other techniques to try and say, ‘Well what’s the behavior of this entity,'” says Scriffignano. The new paradigm for decision-making is using the data we have at our disposal to generate true insights—and answer meaningful questions.

Shifting risk is not usually a first order problem, it’s a second or a third order problem. We have to look at what we know and can see, and how this interacts with other things, and how they interact. We have to test our hypotheses.

Anthony Scriffignano, Chief Data Scientist, Dun & Bradstreet

It’s easy to look at the vast quantities of data and turn the other way, choosing only that which informs our current perceptions. It’s easy to base our business relationships on the visible and the known. It’s also easy to ask the wrong questions of the data we have available. What might occur in a world simultaneously growing more connected and disconnected, according to Scriffignano, is that we use data merely to shift risk rather than manage it or optimize it. “Understanding the mix, understanding the complex interplay of all of this data is not for the fainthearted. There’s an expression. ‘Be careful if you set out to flood a desert; you may succeed by draining an ocean.’ You get what you want, but you cause something else that’s worse. Shifting risk is not usually a first order problem, it’s a second or a third order problem. We have to look at what we know and can see, and how this interacts with other things, and how they interact. We have to test our hypotheses.” As the transactional footprints and digitalization of social behavior expand in breadth and velocity, relationships are all we have in an environment where disconnection shapes the dialogue. And data does not give us better relationships, but insight does.

Ganguli adds, “Basically, it depends on knowing your business and customers very well. Because we’re in the age of data, we have the ability to look at data to find patterns.” Data is the vehicle to find the knowledge we need to have successful relationships, but what is data without insight?

What we truly need isn’t more data, but more relationships.

+202 21262929

+202 21262929